extended child tax credit 2022

Taxpayers who either qualify for the Empire State child credit or the earned income credit of at least 100 or both will qualify for the new stimulus check from New York. How Expansion Could Eliminate Poverty for Millions.

Investment Tax Credit For Solar Power Solar Tax Credits Solar Power

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to.

. A couple that makes about 100000 with two qualifying children under the age of six can expect to receive 7200 under the new plan. New Yorkers who received the Empire State Child Credit or the Earned Income Credit on their 2021 tax returns are now eligible for another one-time payment through the. But others are still.

This means that the credit will revert to the previous amounts. The legislation made the existing 2000 credit per child more generous with up to 3600 per child under age 6 and 3000 per child ages 6 through 17. After the advanced payment greatly helped families many are asking for advanced payments again.

Higgins highlights Child Tax Credit changes designed to help working families get ahead Submitted. Child Tax Credit Schedule 2022. Wed May 12th 2021 0555 pm.

File a federal return to claim your child tax credit. Family Security Act and possible 350 monthly. What is the child tax credit in 2022.

Leading the charge is President Joe Biden himself who included a proposal to extend the enhanced child tax credit through Dec. 31 2022 in his Build Back Better plan. This money was authorized by the.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The expanded Child Tax Credit provided a ladder out of poverty for millions of families. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan.

The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. The credit amount was increased for 2021. 9 hours agoToday as new data from the Census Bureau showed that child poverty dropped to a record low in 2021 in large part as a result of the expanded Child Tax Credit CTC US.

This is in line with the program. Eligible families are those who meet the requirements. Most recently lawmakers proposed extending the child tax credit to just one year in an effort to trim the cost of President Joe Bidens 35 trillion plan.

If a family meets the income requirements and has received each payment between July and December of this year they. 1 day agoA household can receive up to 3600 for each child under six years old and up to 3000 for each child between six and 17 years old if they file a tax return before mid. Sep 11 2022 at 300 am.

The expansion made the child tax credit worth up to 3600 a year per child rather than 2000 and made it a monthly payment rather than an annual windfall. Taxpayers can get up to 3000 for the 2022 tax year if theyve got an unborn child with a detectable heartbeat between July 20 and Dec. Following the failure of President Joe Bidens Build Back Better strategy in Congress earlier in 2022 ten states are giving financial assistance to families.

Since July the federal government has sent the families of 61 million children monthly payments of 300 per child under 6 and 250 per older child. Her career on the court taught me life lessons. New research shows a permanently expanded child tax credit could bring benefits 10 times greater.

The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. 2022 Child Tax Credit.

Families could be eligible to. We will have Child Tax Credit in 2022 to help working families with income covered by the program. In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit.

HOW MUCH MORE MONEY WILL I GET IN 2022. Millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. Child Tax Credit in 2022.

Simple or complex always free.

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Solar Investment Tax Credit To Be Extended 10 Years At 30 Pv Magazine Usa In 2022 Tax Credits Investing Credit Score

Tax Tip Tuesday In 2022 Tax Deductions Tax Payment Federal Income Tax

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Free Tax Information In 2022 Tax Software Estimated Tax Payments Filing Taxes

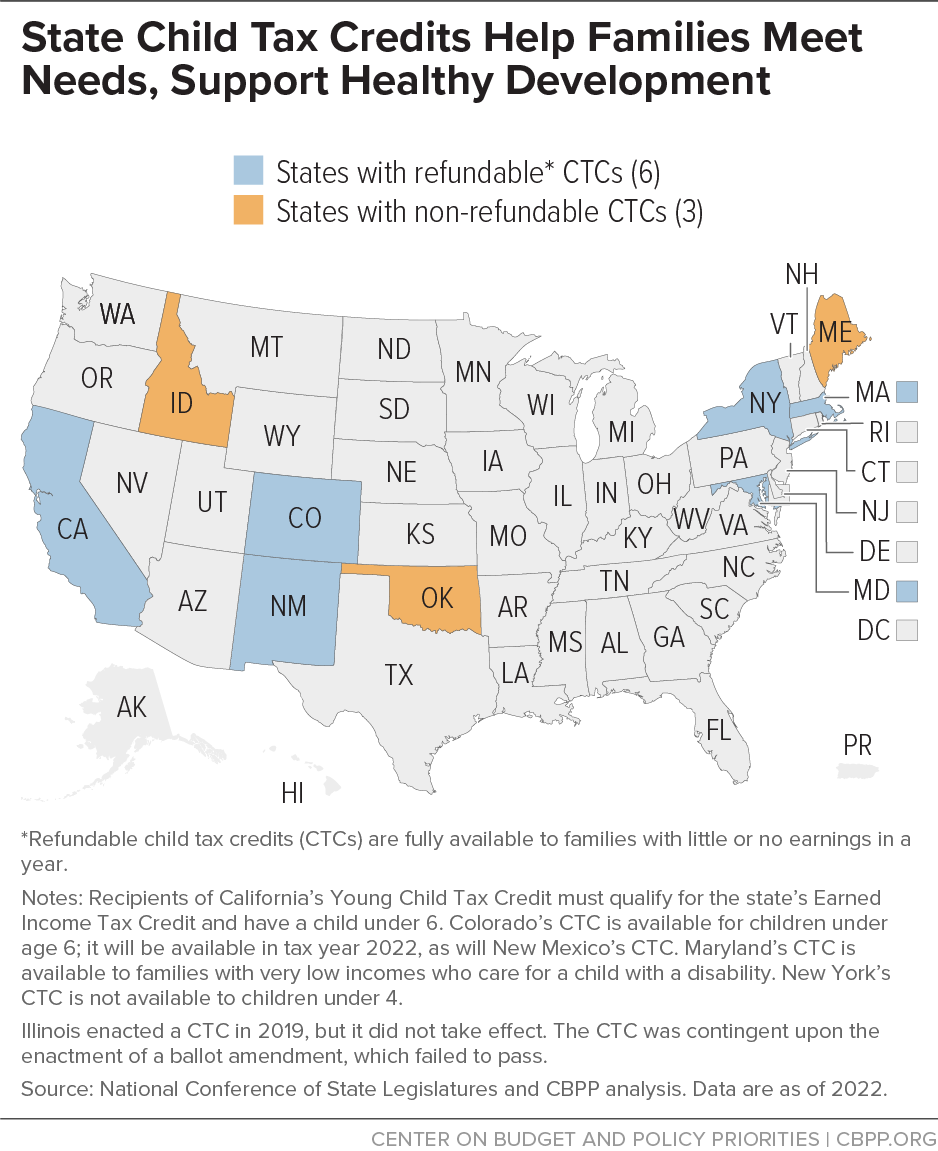

States Should Create And Expand Child Tax Credits Center On Budget And Policy Priorities

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Income Tax

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Major Key Highlights On Tax In Budget 2022 23 In 2022 Budgeting Tax Software Major Key

All About Filing Of 10ee Form By Pensioners With Rule 21aaa In 2022 Tax Forms Pensions Retirement Benefits

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

/cdn.vox-cdn.com/uploads/chorus_image/image/71300653/bigbill.0.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Child Tax Credit Will There Be Another Check In April 2022 Marca

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Latest Gst And Income Tax Compliance Calendar For May 2022 In 2022 Tax Software Income Tax Compliance

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks